Indirect Tax Manager Salary in the United States

How much does an Indirect Tax Manager make in the United States? The average Indirect Tax Manager salary in the United States is $173,386 as of April 01, 2025, but the salary range typically falls between $156,207 and $193,410. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

- View Hourly Wages

- Adjust Indirect Tax Manager Salary:

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

Indirect Tax Manager

Review the job openings and experience requirements for the Indirect Tax Manager job to confirm that it is the job you are seeking.

See user submitted job responsibilities for Indirect Tax Manager.

Search Indirect Tax Manager Job Openings

What does an Indirect Tax Manager do?

View Job Skills and Competency Data for more than 15,000 Job Titles, 18 Industries, and 26 Job Families.

Skills LibraryOur job description management tool- JobArchitect streamlines your job description process. Say goodbye to the hassle of crafting job descriptions.

Explore JobArchitectNot the job you're looking for? Search more salaries here:

Are you an HR manager or compensation specialist?

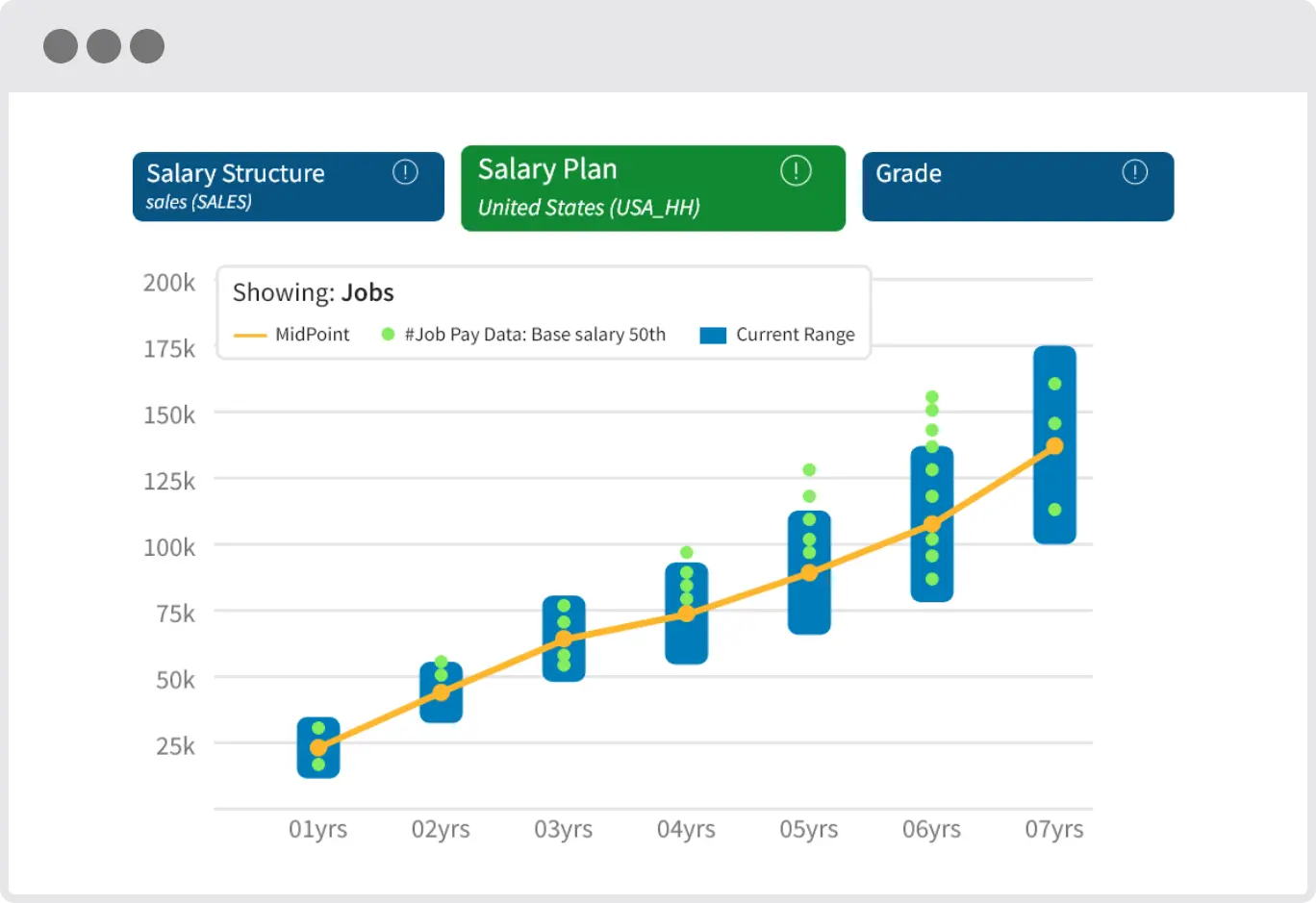

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Indirect Tax Manager Salary by State

Understand the total compensation opportunity for an Indirect Tax Manager, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

Learn more about: Compensation Packages, Employee Flight Risk, Gender Pay Gap, Job Openings for This Role

Jobs with a similar salary range to Indirect Tax Manager : Tax Associate Director